Checking your information, Mr Whittaker

PPI tax refunds has featured on

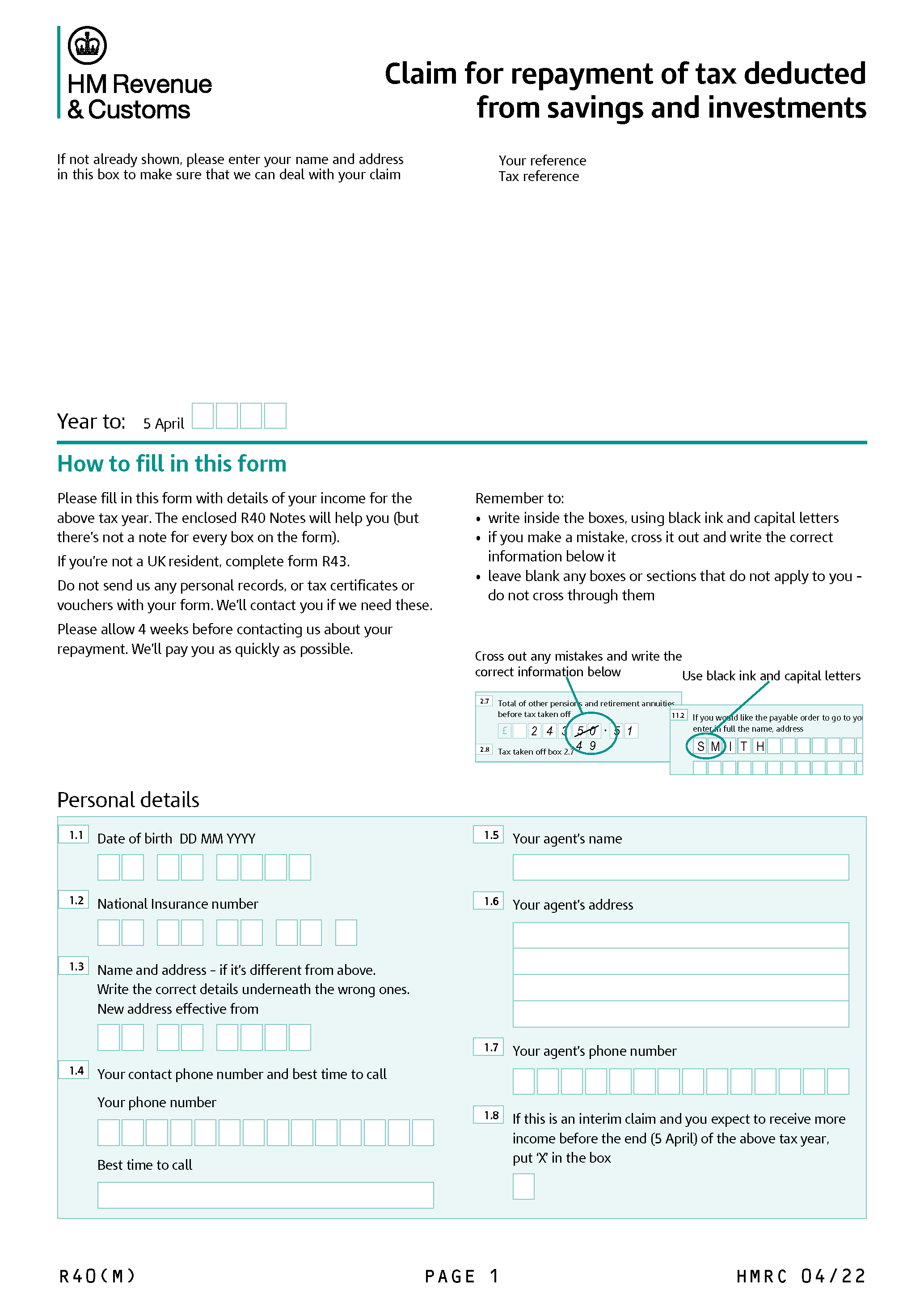

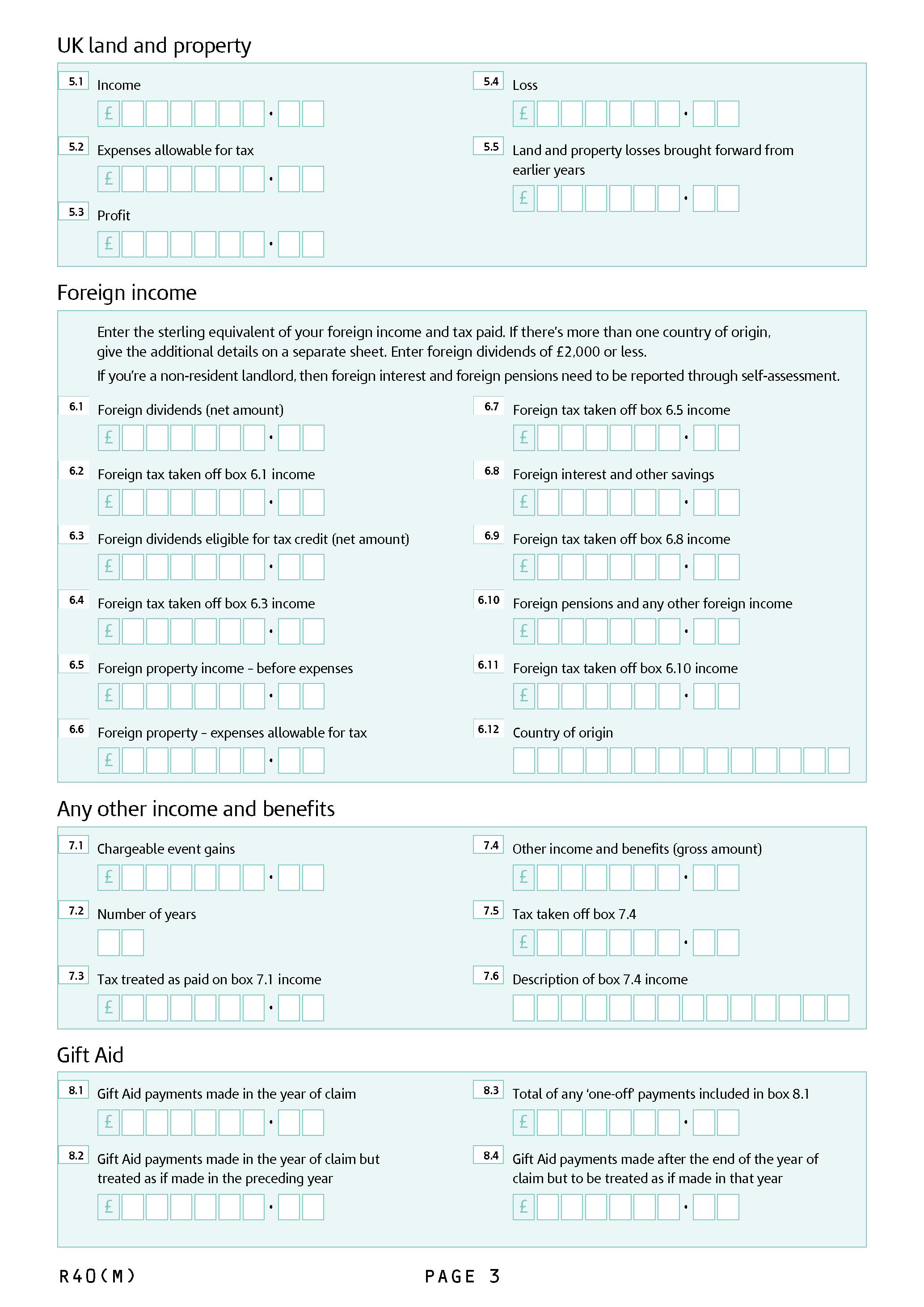

Tax deductions

Tax was only deducted from the statutory interest element of your compensation payment, rather than the entire amount. This means we are not able to take a 'one size fits all' approach, and calculate the 20% from the amount you received.

Through analysis of a large quantity of PPI tax claims and the Offer Letters we have processed, our algorithm is able to generate an estimated amount. This has been pre-populated for you to review and confirm.

The tax deducted from your compensation will have been detailed within the Offer Letter you received from your bank or lender at the time you made your claim. If you still have a copy of this, please review the section relating to the amounts being awarded. You will find the tax deducted here.

If you no longer have a copy of your 'Offer Letter' then you can contact your bank or lender to request the information.

DO NOT CLOSE THIS WINDOW. Your claim is being submitted, . This could take up to 15 - 20 seconds to complete.

Thank you for your patience.

Checking your information, Mr Whittaker